68,000 UK taxpayers currently hold the soon-to-be scrapped ‘non-dom’ status, exempting them from tax on foreign-held income not brought into the country. What changes will the abolition of this status bring? Looking beyond the UK, which other jurisdictions have similar taxation systems? Of those offering resident non-domiciled status, which have the simplest and most favourable rules for acquiring temporary and permanent residence? In an interview with Kommersant UK, Yulia Zabyshnaya, immigration expert at Astons Real Estate, Residency & Citizenship, told us of the different opportunities available to those considering relocation.

Britain is ending the resident non-domiciled tax status, under which foreign incomes are not subject to taxation until they are brought into the country. When will it no longer be possible to be both resident and non-domiciled? What are the reasons behind this change in the taxation of resident non-domiciled individuals?

This is a major event for the UK tax system. The non-dom status has existed here for two centuries, yet from April 6 2025, it will no longer be in force. It is being axed for a whole range of reasons, but the general feeling is that the government is hoping this measure will help replenish their depleted coffers. The Treasury has announced that phasing out the current system will allow another £2.7 billion to be raised by 2028-2029, in addition to the £8.5 billion that resident non-domiciled individuals currently pay every year. A transition period will be introduced for new non-dom taxpayers who acquire the status in 2025; for four years, their foreign assets are exempt from taxation (previously it was 15 years), but after this period they must declare their overseas income and pay tax on it in Britain. From the 2025-26 financial year, those who became non-doms before 2025 will have to pay 50% of the current corporate tax rate on foreign income (but not on foreign remittances). Ultimately, they will pay the tax in full. Also, for sales taking place after April 2025, capital assets will be reevaluated to the level of 2019. Besides this, named individuals will be able to bring to Britain overseas income made before April 2025 at the reduced tax rate of 12%.

What types of financial transactions from abroad are affected by this rule change?

Income such as dividends from overseas companies, interest on foreign loans, income from the sale of property overseas, royalties from foreign licences etc.

Who will suffer most from the scrapping of the resident non-domiciled status? Will some decide taxation in the UK is too great a burden?

Wealthy non-dom taxpayers are concerned about this decision, but the Chancellor, Jeremy Hunt, claims the conditions for bringing funds into the country are still very favourable. Larger businesses working abroad will lose out, as will emigrant business people who live in Britain and receive an income abroad but do not bring it to the UK.

Will businesses begin to leave the UK en masse? If so, how will this affect the British economy?

Despite the advantages of the new system, with its incentives to bring foreign-held capital into the country, the Office for Budget Responsibility has announced that they expect that, by April 2025, only 10,500 of the 68,800 current holders of non-domiciled status will remain. It’s not yet clear how this will impact the British economy, but many of these business people are highly likely to consider relocating abroad.

What countries are top of the relocation list? Which have the most appealing tax systems?

There are other jurisdictions where comparable tax optimisation systems are in force, such as Ireland, where the rules are similar to the UK, Cyprus, Malta, Greece, Italy and Monaco. For relocators with Russian passports, the most convenient option is perhaps Cyprus, where there is also a non-domiciled system. Greece is also attractive, although its advantages as a tax jurisdiction are less widely known. Greece has offered a resident non-domiciled status for the last 15 years, allowing a fixed sum of €100,000 tax a year to be paid, irrespective of overseas income and assets. For each family member also having an overseas income, an extra €20,000 a year is required. This is a much better deal than paying tax at a sliding rate, which can reach 44%. Applicants for resident non-domiciled status must not have lived in Greece for seven of the last eight years and have invested at least €500,000 in Greek assets. This combination is ideal for investments as part of the golden visa programme.

To receive the status, a one-off payment of €10,000 must also be made. The rules for acquisition of tax resident status here are standard; you must live in the country for at least 183 days during the calendar year.

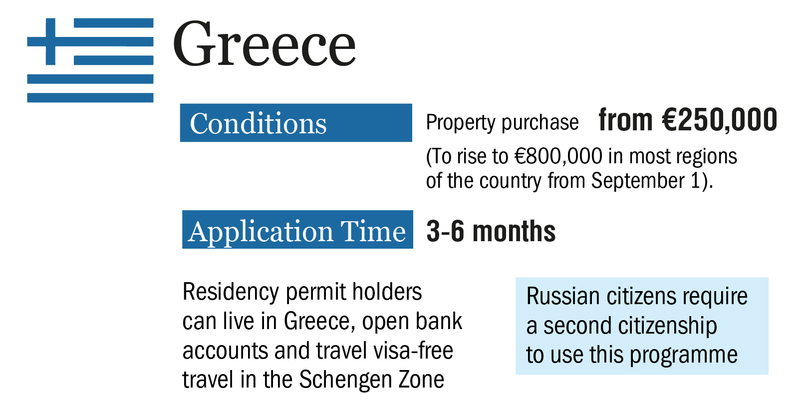

My mentioning of the Golden Visa isn’t incidental, as it’s currently the most efficient and convenient way of receiving a residence permit. For investors from Britain, the cost of property in Greece is quite reasonable. Residence permits may currently be received on purchasing property worth at least €250,000, but from September 2024, the size of the investment required will increase to €400,000-€800,000, depending on how developed and attractive for investment the region is. So, to secure the previous, more favourable conditions, we recommend those hoping to invest before the threshold is raised to pay 10% of the total investment by July 31, as, for civil servants just as much as for everyone else, the holidays begin in August.

Overall, Greece is very favourable in terms of the checks on investors and sources of financing. However, the programme is only accessible to Russians who also hold the citizenship of another country. Investors often come to us to quickly receive a second passport. Vanuatu is one option. The procedure takes only 3-4 months and requires a minimum investment of slightly over $130,000. The passport no longer ensures visa-free travel to the EU or UK, but it is an important step towards residency in Greece. Investors understand that complex solutions are now necessary to feel comfortable internationally. This is especially true for investors from Russia.

Because travelling between Britain and Russia has now become so complicated, many are now looking for a country to relocate to with their relatives. While it is difficult to take your family to the UK, and bringing elderly parents is virtually impossible, Greece has very favourable conditions. In particular, there are no age limitations, unlike in Portugal, where only pension-age relatives (65+) can be brought. What’s more, if there is no need to move to Greece straight away, then the property purchased can be let out to receive a passive income. If a home in Greece is no longer required, after five years it can be sold.

There are other jurisdictions where comparable tax optimisation systems are in force, such as Ireland, where the rules are similar to the UK, Cyprus, Malta, Greece, Italy and Monaco. For relocators with Russian passports, the most convenient option is perhaps Cyprus, where there is also a non-domiciled system. Greece is also attractive, although its advantages as a tax jurisdiction are less widely known.

Greece has offered a resident non-domiciled status for the last 15 years, allowing a fixed sum of €100,000 tax a year to be paid, irrespective of overseas income and assets. For each family member also having an overseas income, an extra €20,000 a year is required. This is a much better deal than paying tax at a sliding rate, which can reach 44%. Applicants for resident non-domiciled status must not have lived in Greece for seven of the last eight years and have invested at least €500,000 in Greek assets. This combination is ideal for investments as part of the golden visa programme.

To receive the status, a one-off payment of €10,000 must also be made. The rules for acquisition of tax resident status here are standard; you must live in the country for at least 183 days during the calendar year.

My mentioning of the Golden Visa isn’t incidental, as it’s currently the most efficient and convenient way of receiving a residence permit. For investors from Britain, the cost of property in Greece is quite reasonable. Residence permits may currently be received on purchasing property worth at least €250,000, but from September 2024, the size of the investment required will increase to €400,000-€800,000, depending on how developed and attractive for investment the region is. So, to secure the previous, more favourable conditions, we recommend those hoping to invest before the threshold is raised to pay 10% of the total investment by July 31, as, for civil servants just as much as for everyone else, the holidays begin in August.

Overall, Greece is very favourable in terms of the checks on investors and sources of financing. However, the programme is only accessible to Russians who also hold the citizenship of another country. Investors often come to us to quickly receive a second passport. Vanuatu is one option. The procedure takes only 3-4 months and requires a minimum investment of slightly over $130,000. The passport no longer ensures visa-free travel to the EU or UK, but it is an important step towards residency in Greece. Investors understand that complex solutions are now necessary to feel comfortable internationally. This is especially true for investors from Russia.

Because travelling between Britain and Russia has now become so complicated, many are now looking for a country to relocate to with their relatives. While it is difficult to take your family to the UK, and bringing elderly parents is virtually impossible, Greece has very favourable conditions. In particular, there are no age limitations, unlike in Portugal, where only pension-age relatives (65+) can be brought. What’s more, if there is no need to move to Greece straight away, then the property purchased can be let out to receive a passive income. If a home in Greece is no longer required, after five years it can be sold.

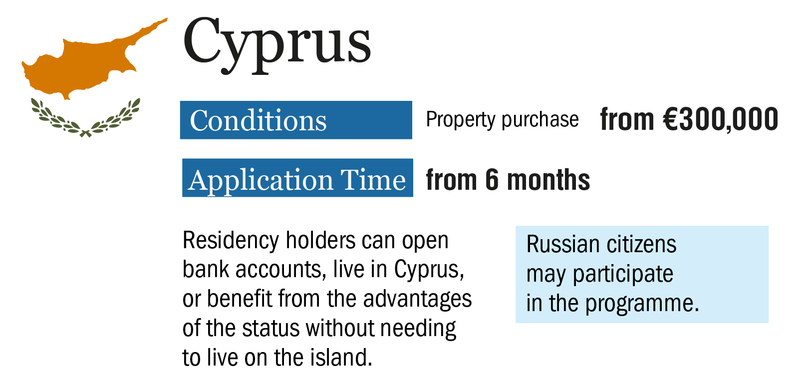

Foreigners may also receive resident non-domiciled status in Cyprus, which is valid for 17 years. Holders of this status are exempt from personal income tax (whether the income is received in Cyprus or overseas), Special Defence Contributions, tax on foreign dividends and assets and also inheritance and capital gains tax. Several requirements must be met to receive this status; an investment in property worth at least €300,000 (this allows you to receive residency immediately) and the requisite number of days must be spent in the country during a single tax year. There are two options; the first is to live in Cyprus for at least 183 days. The second is to spend at least 60 days in Cyprus, not to live for more than 183 days in any other country and not to be a tax resident in any other jurisdiction (no other country in the world has similar rules). This option suits frequent travellers. In this case, a financial link to the republic is also required.

Is tax optimisation the only reason investors apply for foreign residency permits?

Investors’ motivations vary. For a certain category of people, lower tax rates are the dominant factor. Due to their birth citizenship, Russians may be driven by their personal circumstances and professional lives. Of course, it’s now very desirable for Russian citizens to become dual nationals and receive foreign residency permits, especially in Europe.

For them, EU residency is virtually the only ticket to unhindered global travel. It allows them to do business here and send their children to study in Europe or the UK. But these programmes are not only in demand from Russians; we also receive inquiries from the citizens of other countries such as the US, China and the UK. The world is unstable and literally everyone feels it’s prudent to have a plan B. The Cypriot programme, for instance, is popular with Brits, as English is the second state language there. The Greek programme is also in demand as it allows visa-free travel around Europe. Both also make it possible to live in a mild Mediterranean climate on a sunny seashore, which is another attraction.

I’d note that Astons does not give consultations on tax optimisation, instead, we focus exclusively on immigration programmes and the sale of property. If an investor needs consultation on tax, the company has a wide network of trusted partners who can give expert advice on the questions concerning them.

In today’s climate, to be able to travel freely, diversify your assets, broaden your horizons and feel more like a citizen of the world, free from the contingencies and intrigues of great power politics, investment immigration is the key